The future of sports betting pt.2

The future of sports betting hinges on demographic changes, the rise of esports, and cryptocurrency adoption.

The world of eSports, also known as eGames or Electronic Games, comprises organized competitive events in the realm of video games. It shares many similarities with traditional organized competitions, wherein teams and players compete against each other, aiming to ascend the rankings or emerge victorious in tournaments.

In the 90s, it was primarily an entertainment industry, but it has since evolved into a highly structured and organized professional sport. Teams and players engage in competitions within their respective leagues, games, and organizations. The idea of incorporating eSports into the Olympics is even under consideration.

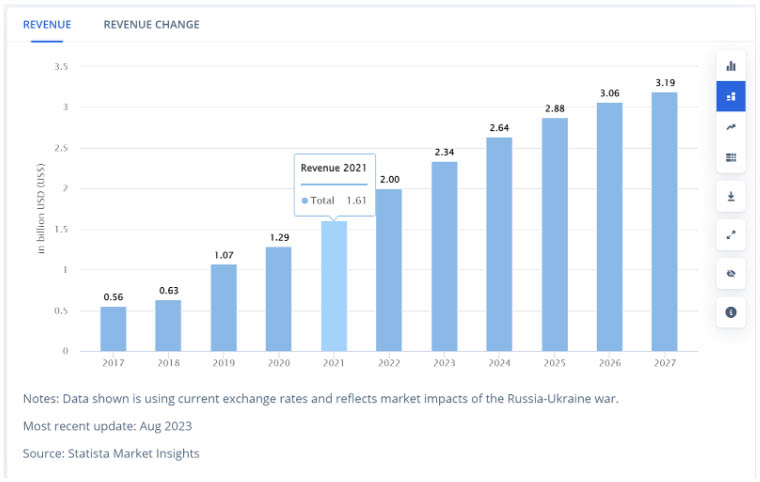

Per statista.com we can see how the betting on eSports tripled in revenue from 2017. till 2021.

Revenue in the Esports Betting market is projected to reach US$2.34bn in 2023. Revenue is expected to show an annual growth rate (CAGR 2023-2027) of 8.05%, resulting in a projected market volume of US$3.19bn by 2027.

In 2022, the global eSports audience reached 532 million people. This number is anticipated to continue to grow, with over 640 million viewers worldwide expected by 2025. These viewers will tune in to watch their favorite games played by some of the world’s most skilled gamers.

With those numbers in rise the leading betting companies are seeing the opportunity to incorporate eSports in their offer. Some of them already are sponsoring big events and teams.

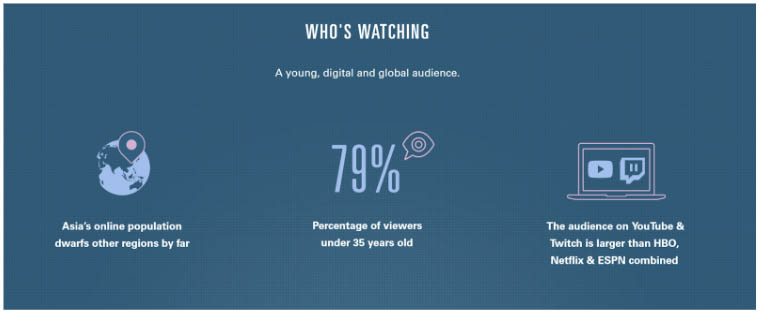

The esports sector is widely regarded as a golden opportunity to target a younger demographic.

According to the Fantasy Sports & Gaming Association, the average age of a sports bettor in the US is 38.

According to Fnatic and Nielsen’s white paper released in January 2022, 68% of global esports fans are under the age of 35. The average age of NFL and MLB fans is 50 and 57 respectively, as reported by the Sports Business Journal in 2017. There is a clearly established upwards trend in age throughout the years, and big sports leagues have a big issue as the younger generation are increasingly less plugged into traditional cable and network television. Existing business models need to change if they are to capture the coming generation.

Observing these numbers, it is inevitable that esports will claim a significant share in the betting industry. Traditional sports bettors are aging, and the majority of the younger generation will become the predominant demographic in the market, shaping the main betting population.

The demographic of esports enthusiasts is aging, and as a whole, they are accruing more wealth. Additionally, there is a rising trend of younger individuals engaging with esports content, following esports stars, and investing in associated products. The growth of esports betting has been remarkable and is expected to surpass the growth rate of any traditional sport. As eSports is faster paced than traditional sports, the younger population is leaning towards eSports. A survey of young Americans found 75% of 21-35-year-olds said esports took them away from traditional sports patronage.

At the end of the day, if we simply observe our surroundings with an unaided eye, predicting the future trajectory and identifying the upcoming bettors and their current habits is not challenging. The significant amount of time people spend on phones, tablets, and streaming services makes it highly foreseeable that esports will claim a substantial share of the betting industry. However, the extent of its impact remains uncertain, and whether it will be in direct competition with sports betting or if they can coexist and thrive together is a question that only the future can answer.

While traditional sports still dominate the global market, esports has surged, attracting significant investments from corporations, internet firms, and even traditional sports governing bodies. Esports competitions boast multimillion-dollar prize pools, and top players can earn substantial incomes through endorsement deals and live broadcast viewership.

Contrasting with traditional sports, FC Barcelona reported nearly $1 billion in revenue for the 2018/2019 season. Even if esports reaches a $5 billion industry in the next five years, it would still be comparable to the top 15 teams in the English Premier League. This is a notable achievement, considering the current trend of slower growth.

Despite a challenging 2020 and 2021 for many esports companies, the industry demonstrated resilience during the COVID-19 downturn. In 2023, with nearly full recovery, gaming outperformed similar industries, growing by 9.3% in 2019, 12% in 2020, and 15% in 2021. In contrast, traditional sports, such as the Premier League, experienced a decline in ticket sales over the same period.

As Esports gains traction, the dynamics of endorsements and sponsorships are evolving. Unlike conventional sports, Esports leverages the popularity of gamers with massive online followings, making them attractive targets for advertising aimed at a younger audience. Some traditional sports leagues have entered Esports by creating or acquiring teams, fostering brand partnerships as businesses aim to tap into the growing phenomenon of competitive gaming. While conventional sports maintain a significant edge in global brand awareness, Esports' unique approach to sponsorship and endorsements is reshaping the landscape.

Traditional sports and esports don't have to be adversaries in the betting industry; they can collaborate effectively. Not limited to F1 teams, various high-value sports operations, including renowned soccer clubs like Manchester City and Bayern Munich, are venturing into esports. These clubs establish esports teams that participate in major online tournaments, spanning games such as EA FIFA and Pro Evolution Soccer. Some soccer clubs are going beyond and fielding teams in tournaments for games like League of Legends and Counter-Strike. A notable example is Besiktas, the Turkish giants, who, since their establishment in 2019, have secured numerous titles and accolades in the esports arena.

Many of these are taking place in the US, with sports stars like Steph Curry and Kevin Durant even going so far as to invest in Esports companies for which they think the sky's the limit. Shaquille O'Neal invested in $155 million NRG Esports after seeing 30,000 kids get involved in a League of Legends.

The future of sports betting hinges on demographic changes, the rise of esports, and cryptocurrency adoption.

Sports betting has evolved to online platforms with $45B revenue.Europe leads, Southeast Asia and Latin America show rapid growth, and crypto betting is rising.

Discover Fairspin's blockchain sportsbook: diverse offerings, user-friendly interface, competitive odds. Rated 9.1/10.

Discover Fairspin: Enjoy seamless payments with cryptocurrencies, enticing bonuses, and responsive support. Dive into our detailed review now!

Consider all pros and cons when betting on major events. Establish your limits, manage your bankroll, and maintain discipline.