The future of sports betting pt.2

The future of sports betting hinges on demographic changes, the rise of esports, and cryptocurrency adoption.

We've already discussed the correlation between probability and odds. When we say something has a 50% chance of happening, we would assume that the odds for this event are always 2.00. Does that make sense? If you have two evenly matched tennis players, we assume that both of their chances are around 50%, so the correct odds for each in decimal format would be 2.00. Therefore, if the probability is 50% or 0.5, the odds will be calculated as 1/0.5, resulting in 2.00.

If you visit a casino and play games like roulette or similar games, you can precisely calculate the probability of an event occurring, and the casino adds a calculated margin to every probability. So, if you're a casino gambler, you're almost certain to lose money in the long run. On the other hand, in sports, the probability of something happening is merely an estimate, far from a certainty, as numerous factors can influence whether an event occurs or not. So the bookmaker has to be aware that the bettor might have access to information and, therefore, an advantage over the bookmaker that is not available to casino bettors. So, in case the bettor has more valuable info than the bookmaker itself, he actually might be winning in the long run.

But, it is not as easy as it sounds.

Let's consider a match between Djokovic and Medvedev where the estimated probability of Djokovic winning is 75%. This estimation translates to odds of 1/0.75=1.333. Conversely, Medvedev has a 25% chance of winning, resulting in odds of 1/0.25=4. Now, assuming this estimation is highly accurate and the market reflects the same probabilities, 75% of the population will place a $1 bet on Djokovic, while the remaining 25% will bet the same amount on Medvedev.

This would mean that $750 would be placed on Djokovic with odds of 1.333, resulting in a total payout of $1000 and a profit of $250 if Djokovic wins. However, all $250 placed on Medvedev would be lost if Djokovic wins. In this scenario, the bookmaker would earn $0. It's important to note that this outcome holds true only if we assume that the market accurately reflects the estimated odds.

Of course if you consider just one match, and not a long run, the stakes will never be perfectly split between team 1 and team 2. So all this works just on a long run scale.

So if the fair odds would be offered by a bookie on a long run, he wouldn’t make any profit. So, of course no one would offer just the fair odds to be honest. Every bookmaker wants to make profit, and that is why they do the business obviously. So to be profitable in the long run, the bookmaker will shorten the prices.

So, how does this process work, and how does it directly affect the odds? Bookmakers adjust the probability for each outcome in order to achieve their desired, what we call, 'odds key.'

For example, if we have the probability of Djokovic winning at 75% and Medvedev's probability at 25%, which totals 100%, bookies would typically add a certain percentage to this total. The exact percentage they add to the market depends on various factors such as the sport, type of a bet, timing, turnover, and so forth. Let’s say our bookmaker decided to add a 10% for this event and split it proportionally through the market, so 7,5% to Djokovic, and 2.5% to Medvedev.

Djokovic to win : realistic probability of 75% becomes 82.5% which equals to 1/0.825=1.212

Medvedev to win: realistic probability of 25% becomes 27.5% which equals to 1/0.275=3.636

So let’s say the same 750$ would be placed on Djokovic to win, the total payout would be 909$. Which is a significant difference of -91$ payout, and that is the bookies margin to make a profit in the long run.

So in the industry if you look for the odds key and differences between the odds key you will see numbers higher than 100%.

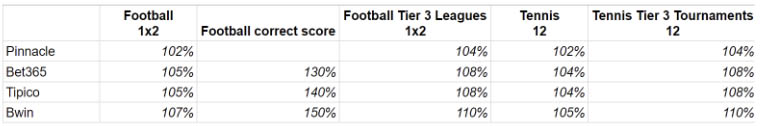

You can observe that Pinnacle maintains narrow profit margins and is considerably more generous than European bookmakers. Bookmakers tend to devalue two-way markets less than markets with a larger number of possible outcomes. Estimating probabilities for total goals is notably easier than predicting the correct score. Markets like total goals or the winner market attract a greater volume of bets, which means bookmakers have access to more information, allowing for more accurate probability projections in these markets. So the less info the bookmaker has, he will devalue the price and add some additional margin.

If you examine the examples below, you can observe that in the first one, you have an odds key of 110%, while in the second one, the bookmaker's margin is slightly lower, at around 107.12%.

The reason for this difference lies in the league/tournament in which those players compete. One is a high-tier ATP tournament, while the other is a semi-pro ITF tournament, and it's also a doubles match. Naturally, ATP tournaments are much more well-known, have more extensive data and statistics available, allowing the bookmaker to estimate probabilities more accurately and, as a result, offer narrower margins.

In the screenshot below, you can see that it doesn't depend solely on the tournament; the odds keys can vary from market to market, even within the same match. Whenever there is a slightly higher chance of an error in the estimation of probability, the bookmaker will protect themselves by adding more margin.

The future of sports betting hinges on demographic changes, the rise of esports, and cryptocurrency adoption.

Sports betting has evolved to online platforms with $45B revenue.Europe leads, Southeast Asia and Latin America show rapid growth, and crypto betting is rising.

Discover Fairspin's blockchain sportsbook: diverse offerings, user-friendly interface, competitive odds. Rated 9.1/10.

Discover Fairspin: Enjoy seamless payments with cryptocurrencies, enticing bonuses, and responsive support. Dive into our detailed review now!

Consider all pros and cons when betting on major events. Establish your limits, manage your bankroll, and maintain discipline.